Initiatives

One North Lake, Pahokee, Florida

A ground-up new construction of a multi-family (40-unit) residential building and possible adaptive reuse of a few historic buildings across the street for commercial use).

Our partners in Pahokee are Donia Roberts and her husband Matt Roberts, their brother-in-law Brian Loughman, and their friend Preston Fields, who have acquired the main parcel. Frances Brandt (CIDC) is the consultant to Palm Beach County and has introduced us to supportive officials there, including Deputy Commissioner Sherry Howard, Meri Weymer, and David Jaco, who meet with us weekly on each project in the county and have invested in CDBG (Community Development Block Grants), which compelled us to change the Sheridan Florida Operating agreement to include our Southern Partners. We had to tweak both agreements again for the FHA approval process. We conducted an FHA-approved appraisal of the land and the market study that will determine our rents (which FHA requires must be done by different entities). We were approved for a $6.9 FHA mortgage from Newmark (Lance Wilson and Janet Bujko) and are working with them to provide HUD with what it needs for the construction financing and mortgage.

We have hired Zyscovich (Alan Wolfe) (Zyscovich.com) as our architect and Aaron Taylor as our planner and have been meeting weekly to get construction drawings done. Atlantic Engineering (Imtiaz Ahmed) is working as our engineer and builder.

There was an issue about the extent of the previous environmental cleanup and underground oil tanks –. The Loan will also allow (require) us to look at two historic buildings across the street (which Donia has acquired partially with assistance from Len and Chuck, which we hope will provide some commercial units as a separate project). RMA will manage the project(s) when it is done, hiring a local manager to do the on-site work.

The Operating Agreement now reflects Relocation Sheridan OZ Fund “RSOZ” 39%; Davina OZ Fund 39%; Lesnick OZ Fund 2.02%; Donia Roberts 6.66%; Preston J. Fields 6.66%; Brian Loughman 6.66%. Phil is committed to $250,000, which could be adjusted depending on construction costs.

Danza of Westgate in West Palm Beach

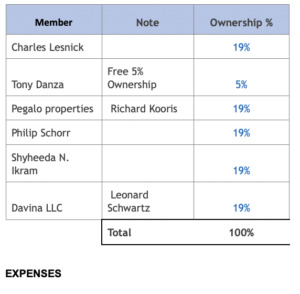

We took over the rights that Tony Danza had to a 40-unit multi-family project with three commercial tenants whom Tony has identified. Danza will stay in for 5%, and Phil, Len, Syheeda Ikram (Anil’s wife), Richard, and I are each in for 19%. This is not an OZ project, but it has a decent rate of return on very little cash and an opportunity to manage in a geographic area where we are starting to have an economy of scale. There will be a commercial condo for Professional Space (one is already committed), and the Westgate/Belvedere CRA has signed a commitment for a lease for a minimum of 10 years.

Nowadays, we own seven parcels at Westgate, ready to start the construction project.

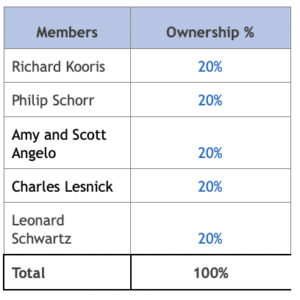

Commercial Kitchen, Lake Park, Florida

Amy & Scott Angelo of Oceana Coffee, Richard, Len, Phil, and I are partners of Lake Park O3, a non-OZ project. We purchased the $700,000 property with a loan from the Bank of Belle Glade. The Palm Beach Economic Development Authority is very supportive of the project. This project has five equal partners with non-OZ money: Phil, Chuck, Len (Davina), Richard Kooris (Pegalo), and Amy & Scott Angelo (as one). The Angelos also own Oceana Coffee which is the anchor Tenant. Another Tenant is the Florida Canning Company which the same ownership group owns as Lake Park O3. We had some previous architects who did not work well, but we are delighted with our current architect Emilio Leobo of One A Architecture. On December 6, 2021, the Planning & Zoning Board unanimously approved our site plan. The City Council followed suit on December 15. We now have our entitlements and development order.

Now we are in the first phase of the construction project; the demolition was officially completed and passed the city inspection last July 13th, 2023.

Florida Canning Company.

We are owned by the same ownership group as Lake Park 03. Amy & Scott Angelo, Richard, Len, Phil, and Chuck are equal partners with non-OZ money. We will get SBA financing to purchase M/E and pay for the fit-out of our condo unit. (we indeed to create an affiliate in Austin with OZ money to operate in the OZ).

Danza of Daytona (Commercial Kitchen)

This project, two lots located in an OZ Zone in Daytona Beach, FL, is for a Commercial Kitchen and 56-unit Multi-family FHA-backed Housing. There is an existing building (a church) on site that will be renovated and converted to Kitchens, packaging production, and retail selling products produced in the kitchen.

Len has met with the Mayor and City manager, who fully support the project and have suggested additional opportunities. The City wishes to combine the lots, although we can still submit for approval in stages. The Housing and the Kitchen will be two separate single-purpose entities.

2101 East Ben White-Austin Community Kitchen in Austin, Texas

Richard Kooris, a partner with CIDC, and Len in the O3 Asset Management funds has his Property interests in Austin and found a building in the OZ for the project, which will be modeled after the Commercial Kitchen in Lake Park (which is not in an OZ.)

Of the $1.8 million of initial equity required, Davina OZ and Relocation Sheridan OZ fund each committed $250,000 before the land purchase’s December 10, 2021, closing date.

Commercial Kitchen, Newark

Potential Partnership with the Urban League of Essex County for a Non-OZ project with a Commercial Kitchen and possibly housing down the line. This project came in from CIDC Senior Vice President Nelson Bregon, who leads the discussions with ULEC President Vivian Cox Fraser and VP Julio Colon.

I know the Newark City Council President, Luis Quintana, who supports the project and the team. We are still working on the details, but it may involve hiring TRIAD again to prepare another EDA application.

Broad Howard, Peekskill

The Broad Howard project has general support from the Mayor and Council, but we are before the planning board on the zone change and text amendment (December 14, 2021) and will have to return to them for the site plan.

Christian DiPalermo and Mark Blanchard introduced us, and we have a great team with Niv Rotem, Nanette Bourne, Kristin Pelatti, Ed Dunphy, Robyn Prince, and Lamont Blackstone. David Barburti is the architect. Jean Freedman, the Commissioner of Planning & Development, has been trying to guide the project through the approvals.

We are in contract with David Moshier to purchase the land for $400,000.00 to construct 50-74 new multi-family housing with some commercial on the ground floor. RMA would manage the project both before and after construction. We just purchased (for $645,000.00) a seven-room Victorian with an adjacent 7-9 car parking lot (which would count toward the on-site parking requirement for our property) with the intention of flipping (for as close to $645,000.00 as we can get) the Victorian and keeping the parking. We have been discussing acquiring other parcels with the Dentist and some other property owners.

We can now acquire Dr. Hale’s mixed-use building for $700-850,000 and 24 parking spots. A Developer has offered us $1.5 million to purchase the Moshier property as soon as we get the zone change and text amendment (expected December 14 by the Planning Board and then the City Council thereafter).

While I don’t think we should sell it, there is comfort in knowing there is an escape if we can’t make a project work at this location. I would recommend that we increase the investment from Relocation Sheridan OZ Fund in acquiring more land – some of which will be flipped for profit and all of which makes the project more feasible. As we move forward, we can always take money out of Peekskill and reinvest in other OZ projects.

Veterans Housing

(Colorado, South Sioux City, Omaha, and other sites in ND, SD, CO & TX). Kim Kuhle has a team assembled whom I met in Colorado Springs. I have introduced that team to CapZone, who may be interested in investing. She has already designated RMA to be the Property manager for all the projects, and there is an expectation that we might invest some money in the first two projects – Colorado Springs and South Sioux City which are most far along with local approvals and assemblages of land. She is a former banker, and this is now her life passion.

I have been involved as a consultant and will help her secure bank financing for the land purchase in Colorado. This project has the capacity to absorb several million in OZ Funds with an IRR that promises to be in excess of 20%

CapZone

Mark Germain (18 Squared GP) and Al Puchala (CapZone) have several projects with an IRR of around 15%, all in Opportunity Zones. The projects are ongoing, and Al was willing to give us a small promotion to get us in early. Recently Tocqueville just announced that they would be raising $500 million for OZ projects, and Al wants me to continue to come up with the deal flow. We have invested with them in Albert Lea, Minnesota, and Fort Trumbull in New London, Ct.

We are now looking at Claiborne County, Mississippi, for a potential project with the county administrator Milton Chambliss (the cousin of the former NY Yankee). CapZone does not want to get involved with projects until site control and all entitlements exist. They want to join at second base and bring it home. We are in the trenches on some of these projects working hard to get to first base. There is value in including the development risk; we are learning from our recent experience in Austin how we might capitalize on that.

Nahmias et Fils

A Moroccan Jewish Fig distillery in Yonkers needed $200,000.00 in working capital and equipment for their fig liquor, whiskey, and bourbon to the next level. With Davina OZ, Lesnick OZ, O3 Management Fund, and Roy Stillman each investing $10,000, we got them most of the way to the $50,000 they needed to leverage another $28,000.00 from 95 other people on the WeFunder platform campaign. If RSOZ wanted to replace either O3 or Stillman, we could if we wanted to take advantage of OZ benefits. We identified some NYS matching funds for machinery and equipment for distilleries.

The distillery was about to access $92,000.00 in EIDL money at 3.5% for 30 years. During the pandemic, which saw some of the markets for the alcohol evaporate, we worked closely with the distillery to turn it into a bottler and distributor of hand sanitizer.

RMA Westgate LLC

We have used a few financial services professionals to assist us with bookkeeping and other managemental services and expenses such as software (Quickbooks). Since we created an LLC called RMA Westgate, RMA Westgate bills back its services to each project based on how many hours each person spends on each project each month. Marks Di Palermo has been our leading counsel for each of the projects.

After utilizing Tax Counsel for Pahokee, none have required it since. We have utilized Ken Zinghini of Martin LLP for specific OZ or corporate questions on Atlantic County. He also works with CapZone on some projects. We have used Kaplan Kirsch Rockwell as special FAA Counsel for the Atlantic City Project.

We will be using Steven Daniels of Saul, Ewing Arnstein & Lehr as our Florida Condominium Counsel for several projects where we have separated a commercial condo or two from our residential buildings or have an anchor to the commercial kitchen. Martin Greenberg of Prager Matis is the accountant for most of our projects and OZ funds.

RMA Initiatives and Partnerships

Community Improvement Corporation of Manhattan

In 1968, RMA was chosen by the non-profit Community Improvement Corporation of Manhattan to serve as management consultants for the first group of occupied apartments in NYC to be rehabilitated under a HUD pilot program. The 200 block of West 114th Street in Harlem was the proving ground for future housing rehab programs. RMA was responsible for organizing and training the local management and maintenance staff, establishing operating procedures, planning and preparing annual budgets, creating fiscal and administrative controls to ensure accountability, supervising the temporary transfer of tenants from occupied to vacant apartments, and city officials

Mitchell-Lama Developments and Sec. 8 Housing

In the 1970s, RMA’s activities focused on two government housing programs,” Mitchell-Lama developments at the State/City level and Sec.8 housing at the federal level.RMA was sales, rental, and management agents for Mitchell-Lama coops in the Bronx, Manhattan, and Brooklyn. These projects helped sharpen the management skills of RMA due to the diversity of the locations of the developments and the complexity of administering newly created cooperative housing.

378 Section 8 Units on Fox Street in the South Bronx

RMA was also chosen by HUD to manage Sec. 236- rehab housing developments in East Harlem that were in financial difficulty. This new program provided RMA with an introduction to the new Sec. 8 gut rehab program. In 1973 the firm, along with the New York City Center for Housing Partnerships, joint-ventured to develop 378 Section 8 units in three projects on Fox Street in the South Bronx. As a general partner, RMA provided the seed capital and management capability, a prerequisite for HUD designation as a project sponsor.

Eight vacant buildings on three continuous blocks on Fox Street on Southern Boulevard were rehabilitated from 1973 through 1975. This was the second Section 8 HUD project built in New York City. Its excellent condition today in this once-depressed neighborhood is testimony to the successful effort of RMA’s development and management program. RMA set up local offices with a project manager, certification clerk, superintendent, handyman, and porters. These and other projects have never been delinquent in mortgage payments, nor have they suffered from excessive vacancy losses.

For the past few years, HUD has approved significant Capital grants of over $2,000,000 for their physical improvement, including new roofs, elevators, energy-saving oil burners, replacement windows, gas ranges, refrigerators, kitchen cabinets, and the like. The restored physical condition of the buildings is designed to add another 30 years to their life. Though we subsequently sold the building. We take pride in the fact that it remains the centerpiece of the neighborhood.